LTC Price Prediction: Analyzing the Path to $120 Amid Market Volatility

#LTC

- LTC shows bullish MACD crossover but remains below 20-day MA at $108.637

- Whale activity and institutional interest ($5M+ presale) contrast with ETF delays

- Key range between $95.035 (Lower Bollinger) and $122.239 (Upper Bollinger)

LTC Price Prediction

LTC Technical Analysis: Key Levels to Watch

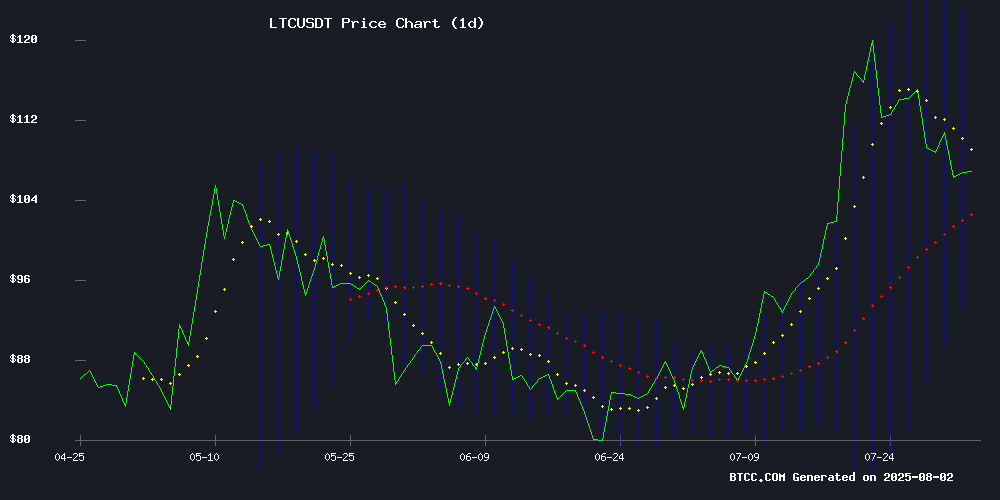

According to BTCC financial analyst James, LTC is currently trading at $107.62, slightly below its 20-day moving average of $108.637. The MACD indicator shows a bullish crossover with the histogram at 3.1587, suggesting potential upward momentum. Bollinger Bands indicate a relatively tight range between $122.239 (upper) and $95.035 (lower), with the middle band at $108.637 acting as immediate resistance. A break above this level could signal further upside.

Market Sentiment: Litecoin Whales and ETF Delays Create Mixed Signals

BTCC's James notes that Litecoin is experiencing conflicting market forces. While whale activity and Web3 developments like BlockDAG's emergence are bullish factors, ETF delays and utility challenges from projects like Unilabs Finance are creating headwinds. The $5M+ cold wallet presale surge indicates strong institutional interest, which may support LTC's price floor.

Factors Influencing LTC's Price

Cold Wallet Presale Surges Past $5.08M Amid Market Volatility

The cryptocurrency market presents a study in contrasts as Cold Wallet's presale accelerates while Pi Network and Litecoin face headwinds. Cold Wallet (CWT) has sold over 643 million tokens, raising $5.08 million across 150 stages, with each subsequent stage priced higher—demonstrating relentless demand.

Pi Network's price teeters near critical support at $0.40 following a $28 million token unlock that flooded the market with new supply. Technical indicators suggest further weakness, with the RSI breaking its trend line and no visible support below current levels. Another token unlock scheduled for August could push PI to new lows.

Litecoin maintains a bullish outlook but struggles to capitalize on its $100–$110 base. The market appears uncertain whether this level will serve as a launchpad or become a persistent resistance zone.

Young Investors Embrace AI Cloud Mining in 2025 as AIXA Miners Gain Traction

Millennials and Generation Z are reshaping investment strategies by turning to automated cryptocurrency mining solutions, with AIXA Miner emerging as a leader in the space. Traditional assets like stocks and real estate have become increasingly inaccessible, driving demand for alternative wealth-building tools.

AIXA Miner's cloud-based platform enables passive income generation through mining popular cryptocurrencies including BTC, ETH, LTC, and DOGE. The service appeals to digital natives with its renewable energy operations, hardware-free setup, and risk-free trial offers. Regulatory compliance and AI-driven efficiency have positioned the platform as a preferred choice among students, entrepreneurs, and part-time investors.

The shift reflects broader generational preferences for mobile-accessible, transparent financial tools that combine technological innovation with sustainable practices. As legacy investment vehicles lose appeal among younger demographics, AI-powered solutions are filling the void with automated systems that require minimal technical knowledge.

BlockDAG Emerges as Web3 Leader Amid PEPE Rally and Litecoin Whale Activity

Cryptocurrency markets exhibit divergent trends, with PEPE and Litecoin capturing trader attention while BlockDAG quietly builds infrastructure. PEPE's price surged 65.7% after breaking a long-term downtrend, with analysts targeting $0.0000145 in the near term. Litecoin shows bullish technical patterns as whale activity intensifies.

BlockDAG distinguishes itself through tangible development progress rather than price speculation. The platform now boasts 4,500 developers and 300+ confirmed Web3 projects—a scale of ecosystem development rarely seen in crypto's speculative landscape. This growth occurs as traders chase PEPE's momentum and LTC's golden cross formation.

Litecoin Tests Key Resistance Amid ETF Delays as Unilabs Gains Traction

Litecoin's price action hinges on a decisive breakout above $110, with traders weighing technical patterns against regulatory headwinds. The SEC's latest delay on Grayscale's proposed LTC ETF underscores persistent institutional adoption barriers for legacy cryptocurrencies.

Meanwhile, Unilabs Finance demonstrates how altcoins are forging alternative growth paths. Its staking mechanism has attracted $31.8 million in assets, while the presale surge past $7 million reflects shifting capital flows toward utility-driven projects.

Crypto Forecast 2025: ADA, Conflux, and Litecoin Face Utility Challenge from Unilabs Finance

As Bitcoin's dominance grows, the altcoin season shows signs of waning. Established tokens like Cardano (ADA) and Litecoin (LTC) are feeling the pressure, with ADA particularly impacted by allegations of financial mismanagement. Despite recent integrations like Apple Pay support through CardanoKit, ADA's price has slumped 10% to $0.773.

Conflux stands out as an exception, displaying bullish momentum amid the broader market downturn. Meanwhile, Unilabs Finance emerges as a disruptive force, leveraging AI capabilities to attract investors seeking both utility and returns.

The market's shifting dynamics raise questions about whether traditional altcoins can compete with innovative newcomers. While Cardano's planned audit may restore some confidence, the project faces stiff competition from Unilabs Finance's value proposition.

AIXA Miner Leads 2025's Top Crypto Cloud Mining Platforms for Passive Income

The cryptocurrency mining landscape is undergoing a seismic shift in 2025 as cloud-based platforms democratize access to passive income. Eight services now dominate this space, with AIXA Miner emerging as the undisputed leader through its combination of regulatory compliance, multi-coin payouts, and institutional-grade security.

What sets these platforms apart is their elimination of traditional barriers—no specialized hardware or technical expertise required. AIXA's value proposition resonates particularly strongly: instant $20 mining credits upon registration, daily payouts in four major cryptocurrencies, and enterprise-level protections including McAfee® and Cloudflare® security layers. The platform's VIP program escalates rewards potential to $400,000 for high-volume participants.

How High Will LTC Price Go?

Based on current technicals and market sentiment, James suggests LTC could test $120 if it sustains above the 20-day MA at $108.637. Key levels to watch:

| Support | Resistance |

|---|---|

| $95.035 (Lower Bollinger) | $108.637 (20-day MA) |

| $100 psychological | $122.239 (Upper Bollinger) |

The MACD crossover and whale activity suggest accumulating pressure for an upward move, though ETF delays may cap short-term gains.